- Purchased or acquired Snap Inc. Class A common stock between Feb 5 and Oct 21, 2021.

- OR acquired Snap call options in the same period.

- OR sold Snap put options during the class period.

- Suffered economic losses related to these transactions.

- Submitted a valid Proof of Claim by May 6, 2026.

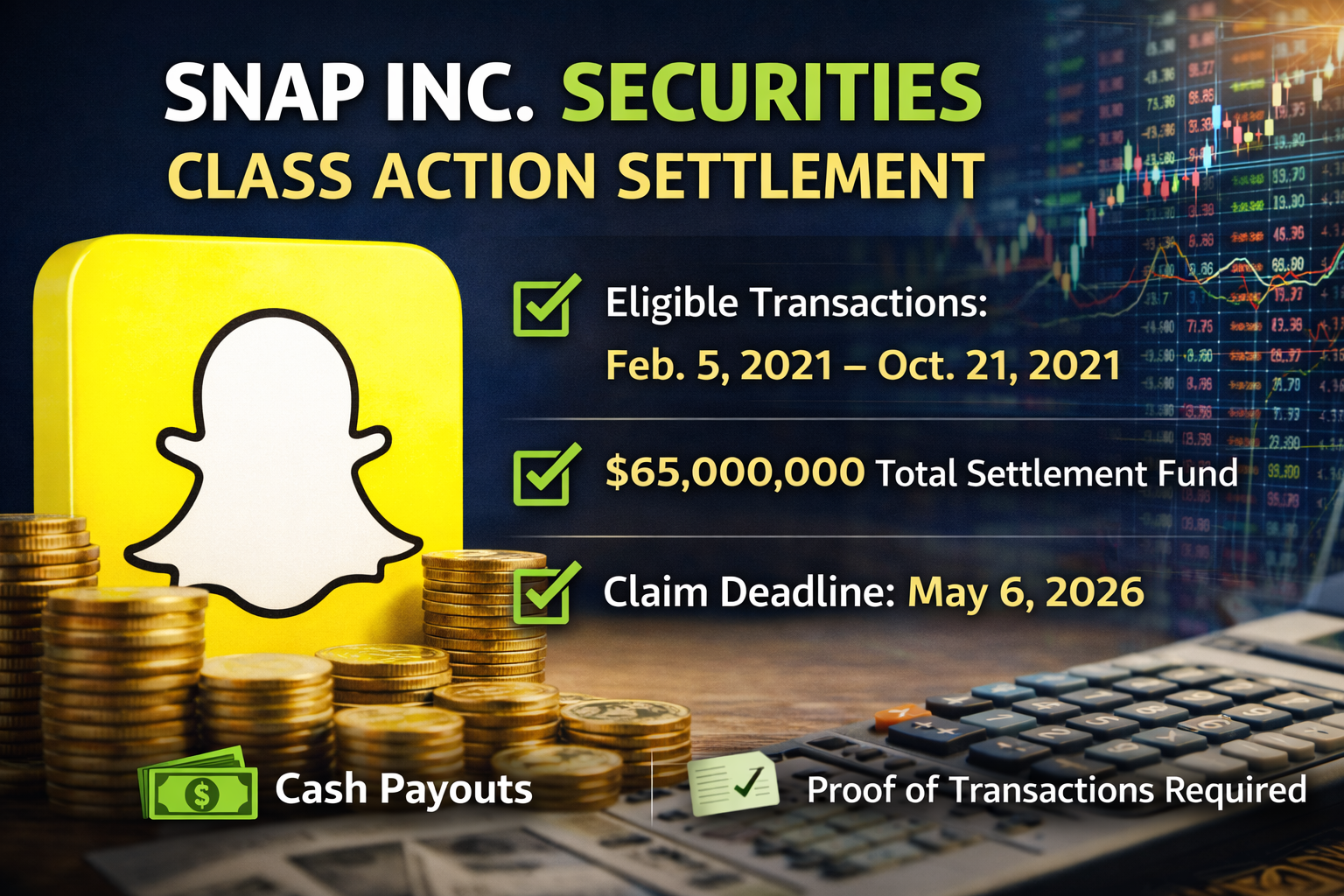

Eligible investors who traded Snap Inc. stock or options between February 5, 2021 and October 21, 2021 may qualify for cash payments from the $65 million settlement.

Snap Inc. Securities Class Action Settlement

Settlement offers cash compensation to investors who bought Snap Inc. stock or certain options during Feb 5–Oct 21, 2021 and suffered losses. Claim deadline: May 6, 2026.

Settlement Overview

The Snap Inc. Securities Class Action Settlement resolves investor claims in Black v. Snap Inc., et al., a lawsuit alleging that Snap Inc., the parent company of Snapchat, made materially false and misleading statements about the company’s financial performance and prospects that artificially inflated the price of publicly traded SNAP securitiesbetween February 5, 2021 and October 21, 2021. Snap and the individual defendants deny any wrongdoing, and there has been no ruling that they violated securities laws; the settlement is a compromise to avoid the uncertainty of continued litigation.

Products or services covered:

This settlement covers financial investments — not physical products or consumer services. Eligible securities include:

- Snap Inc. Class A common stock

- Snap publicly traded securities or call options you purchased or acquired during the class period

- Snap put options you sold during the same period

- if you suffered economic loss due to those transactions.

Why this settlement matters:

Class members may recover a pro-rata share of a $65,000,000 cash settlement fund based on the Net Settlement Fund and the approved Plan of Allocation. Compensation depends on actual investment transactions and losses — meaning payouts will vary among claimants.

Who qualifies:

Investors or entities who:

- Purchased or acquired Snap Inc. common stock or call options; OR

- Sold Snap put options;

- between February 5, 2021 and October 21, 2021 (inclusive), and were damaged by those transactions.

How payouts work:

There is no guaranteed amount per claimant. Approved claims receive a pro-rata share of the Net Settlement Fundafter deductions for fees and expenses. Your share depends on your recognized loss under the Court-approved Plan of Allocation and the total number of valid claims submitted.

2026 Privacy & Security Toolkit - Affiliate

With deadlines approaching fast on January 08, 2026, many people are filing claims for video privacy violations (YouTube Kids, DirectToU, Limited Run Games) and data breaches (First Choice Dental). After helping thousands claim their money, here are the exact tools I personally use and recommend to stay protected moving forward.

Best VPN for Video Privacy (DirectToU, Limited Run Games, YouTube Kids VPPA) - NordVPN

Why it fits these settlements: VPPA cases like YouTube Kids, DirectToU, and Limited Run Games are all about companies sharing your viewing data without consent. NordVPN masks your IP, blocks trackers, and adds strong encryption so your online activity stays private.

Get the current deal up to 50% off!

Top Credit Monitoring & Identity Protection - SmartCredit

Why it fits these settlements: The First Choice Dental data breach exposed personal information that could lead to identity theft. SmartCredit gives you real-time credit alerts, score tracking, and $1 million identity theft insurance — far more proactive than the basic monitoring offered in most breach settlements.

Simple & Affordable Tax Filing - E-file.com

Why it fits these settlements: Most class action payouts are not taxable, but it’s smart to stay organized — especially if you’re claiming multiple settlements this month. E-file.com makes federal and state filing fast, accurate, and budget-friendly.

Amazon Recommendations (Still Reader Favorites)

- Norton 360 Deluxe 2026 (excellent backup identity protection)

- Webcam Cover Pack (physical privacy for video calls/streaming)

- RFID-Blocking Travel Wallet (extra safety for trips after the AirportParking claim)

FAQ

Q: What’s the total settlement value?

A: $65,000,000 in cash deposited into an escrow for the benefit of eligible class members.

Q: Who’s included in the settlement class?

A: Persons and entities who traded Snap Inc. securities in the class period and suffered losses.

Q: Do I need to submit a claim to get money?

A: Yes — you must file a Proof of Claim and Release postmarked or submitted online by May 6, 2026.

Q: Is proof of transaction required?

A: Yes — you must provide detailed trade information and supporting records as part of your claim.

Q: What’s a pro-rata payout?

A: After Court approval, the Net Settlement Fund is divided proportionally based on recognized losses among all approved claims.

Q: When is the fairness hearing?

A: Scheduled for April 23, 2026 to consider final court approval of the settlement.

Who Is Eligible?

How to File a Claim

- Go to the official claim portal.

- Review all instructions and eligibility rules on the site and read the full Notice documents.

- Complete the Proof of Claim and Release form fully, including your contact info and detailed Snap trade data.

- Provide required transaction details (trade dates, number of shares, purchase/sale prices) and supporting documentation.

- Sign and submit online or mail the completed claim form so that it is postmarked no later than May 6, 2026.

- Keep a copy of your claim and supporting documents for your records.

Documentation Requirements

Proof Required

- Claimants must provide detailed transaction information such as trade dates, share counts, purchase and sale prices, and options data on the official Proof of Claim form.

- Supporting documentation like brokerage confirmations or account statements is required to substantiate your claim.

- Without adequate proof and documentation, a claim may be rejected or receive no payment.

Payout Details

• Total settlement fund: $65,000,000 cash.

• Pro-rata payments: Distribution depends on recognized losses and total valid claims.

• Cash benefits only: No vouchers or non-cash awards.

• Distribution method: Claims administrator mails or electronically issues payments after final approval and processing of claims.

Key Information

Varies - Varies

May 6, 2026

74 days left

$65 million

By clicking "Submit Claim Now", you will be directed to the official settlement website to file your claim directly with the settlement administrator.